- I am passionate about – giving small business owners back time!The majority of the time, a small business is run by a couple – usually with one out doing the work, and the other helping in the background. This is all well and good while the business is starting up, but when growth occurs, we often see the ‘behind the scenes’ workload getting more and…

- Why should I have insurance?When we do our clients personal tax returns we’ll talk to them about their insurances and whether they’ve got life insurance and income protection insurance, TPD total permanent disability insurance etc.. We don’t sell insurance, we don’t any money out of it. We are just making sure that our clients have got themselves covered. We…

- Best Ballarat Accountants – Financial Planning and Wealth CreationA lot of our clients will come to us with concerns around where they are heading in their life and what their retirement might be looking like. So although we don’t necessarily do a lot of financial planning ourselves, we do a lot of wealth creation advice for clients. We have a Ballarat financial planner…

- What will June 30 look like for your business?Tax Planning is an opportunity to analyse the current financial year, project potential tax liabilities and discuss strategies moving forward. Further to this, Tax Planning is an opportunity to have a conversation about your goals and aspirations as both a business owner and personally. With your goals and aspirations in mind, tailored advice can be provided,…

- Find Your Lost Superannuation in 3 StepsDid you know that around $18 billion dollars is sitting in 6.3 million lost super accounts? If you’re one of the many Aussies with one or more lost accounts then you better act quickly. “The federal government has changed the super rules, which means that your ‘lost’ super account could be transferred to the ATO…

- 2018-19 Budget UpdateIf you’re interested in finding out what key changes are most likely to impact you, keep reading. Last week Scott Morrison presented the Turnbull Government’s 3rd budget. This budget is best described as ‘incremental’ and has a large focus on integrity measures and cuts to the individual tax paid by most Australians. Personal Income tax Business…

- How a Virtual CFO WorksHow a Virtual CFO Works & What Strategies Are Involved Today we’re talking about our VCFO service and how this can help you with your long term strategy for your business. Typically we find business owners are stuck in the day to day grind of running their business. What we do is help to pull you…

- What is a Virtual Chief Financial Officer (CFO)?A CFO is the Chief Financial Officer. They operate within your business and they provide a high level of strategic advice, and they also oversee a number of parts of your business. A Virtual Chief Financial Officer is all about bringing the CFO experience into everyday businesses like yours. The benefit of having a Virtual…

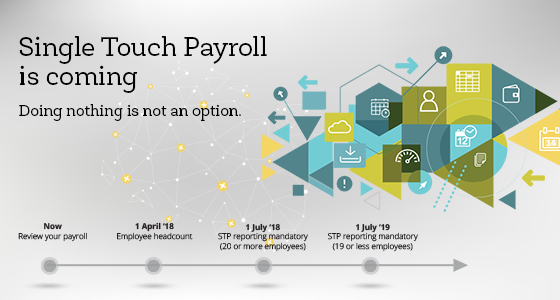

- Single Touch PayrollHi I’m Glenn from Sharp Accounting and today we’ve got a really great question that we’re going to address: I’ve heard there are going to be changes around how wages and superannuation are going to be reported and paid – what does this mean? From the 1st of July 2018, large employers are going to…

- Taking Portable PaymentsHello, it’s Ewen Fletcher from Sharp Accounting! I’m here with our first video of the Cash Flow video series. We’re going to talk about one thing per week on how to improve your cash flow for your business. Now this week I want to talk about portable payments – taking payment when you’re out on a job.…

- How taking upfront payments can improve the cash flow of your businessHow taking upfront payments can improve the cash flow of your business Today we are going to talk about up front payments and how you might utilise these in your business to enhance your cashflow and also provide you with a bit of security in regards to the work your undertaking for your customers. What…

- Does property always increase in value?Hi, I’m Glenn Sharp from Sharp Accounting and welcome to our ‘Ask Sharpy’ videos. Does property always go up in value? The common misconception is that property only ever increases in value. It doesn’t always go up in value. All we’ve got to do is go back to the GFC period to see the most…

If you fail to plan, you plan to fail