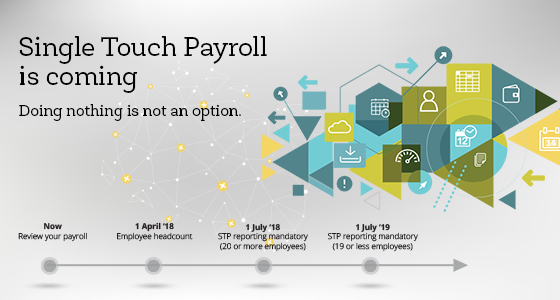

Single Touch Payroll

Hi I’m Glenn from Sharp Accounting and today we’ve got a really great question that we’re going to address:

I’ve heard there are going to be changes around how wages and superannuation are going to be reported and paid – what does this mean?

From the 1st of July 2018, large employers are going to need to report their payroll runs every time they do a pay run.

So they need to report gross wages, the amount of superannuation and the amount as pay as you go withholding tax out of each weekly pay run or fortnightly pay run – when ever you do a pay.

What this means for small business.

If you have less than 20 employees you get an extra 12 months before this kicks in. If you have more than 20 employees it’s from the 1st of July 2018. What it means is you’re going to need to update your software systems to be able to cope with it.

What it also means is that the ATO will know every single time you do a pay, what the superannuation should have been deducted out of each employees and then they will be matching it up to the super payments that you actually make.

What it means for employees it should reduce the amount of super that has been unpaid by rouge employers.

I think its a really good thing. A lot of employees get left in the lurch when the business goes belly up because they haven’t had their superannuation paid for 2 or 3 years.

This should hopefully put a stop to that and the ATO should be on top of those employers who haven’t paid for 2 or 3 months rather than 2 or 3 years.

Its a great system, what it means for small business is that you’re going to have to upgrade your software which hopefully all the software providers will have their stuff together within the next few months.

If you need help on this, feel free to reach out to us.

Full video from the ATO on Single Touch Payroll can be found here

Sharp Accounting is a local accounting firm in Ballarat. Sharp Accounting nurture business growth by adding value through collaboration and shared knowledge.