How to Buy a Commercial Property for Your Business

With commercial interest rates being incredibly low at the moment, many of our clients have asked us about how to buy a commercial property. In this article, we’ll outline considerations for businesses looking at buying a commercial property, the potential benefits, and how to obtain financing.

Benefits of Buying a Commercial Property for Your Business

Here’s a quick overview of just some of the benefits of buying your business property:

- Instead of paying rent to a landlord you are building an asset for your own future and creating wealth

- Owning your business premises can make your business more attractive for potential purchasers when it’s time to exit your business.

- Your commercial property will likely increase in value over time too, so you’re creating wealth by paying rent and reducing debt over a long period of time.

- There are likely to be fewer restrictions placed on the changes you can make and signage you can display in a property you own. Redtape for making any changes will also be reduced.

- Increased ability to plan for the future, since you don’t need to be concerned with negotiating lease options or rental amounts and/or potentially moving at the whims of your landlord.

- You can claim depreciation for your fixtures and fittings.

- As your equity in the business grows, you can use it to grow your asset base and secure finance in the future.

Factors to Determine When to Buy a Commercial Property

Whether to purchase or lease a commercial property is an ongoing consideration for growing businesses. Once it’s financially viable for you to obtain financing (or even purchase outright) a business premise, you’ll need to consider the following:

Commercial Property Prices

You will need to consider whether you can afford a commercial property that offers sufficient floor space, visibility, and parking, as well as how much improvements will cost. Leasehold improvements can prove to be expensive over time, which may make purchasing a property a more strategic decision. However, you also need to consider whether you can afford to purchase in a location that makes sense to your business and allow for any future potential expansion. Considerations here include accessibility for staff, customers, and transportation vehicles (if any); warehousing and storage; proximity to suppliers.

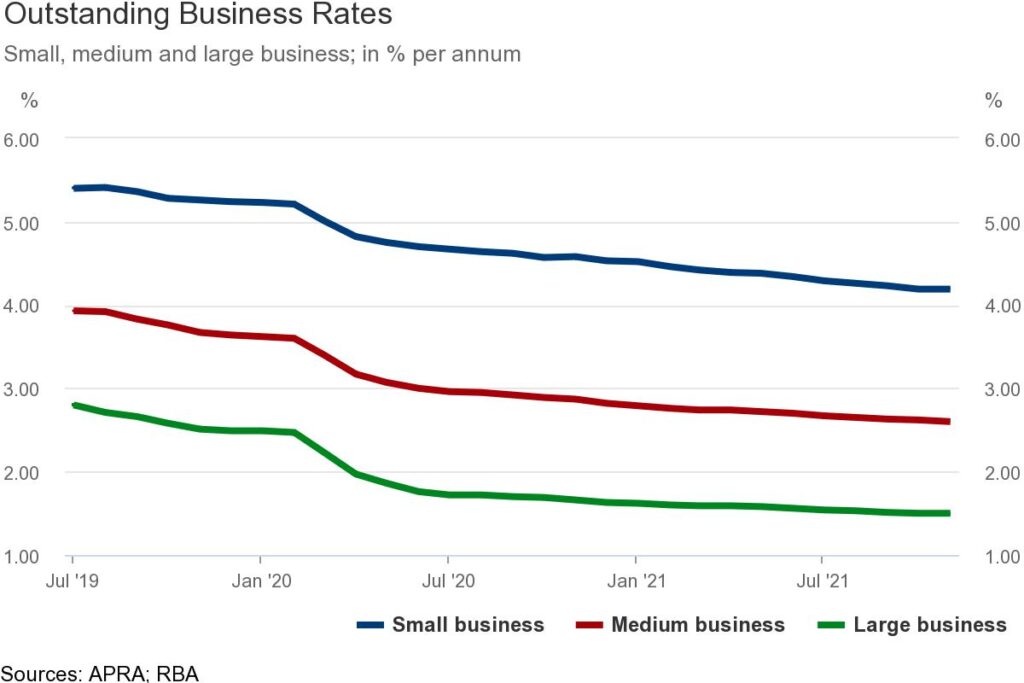

Interest Rates

As we outlined in the introduction, interest rates play a role in your decision to purchase your business premises. At present, commercial interest rates are at a historic low, making it more affordable to service the loan and therefore, more attractive to purchase your business premises. On the flip side to this, asset prices have risen strongly over the last couple of years as interest rates have reduced.

Opportunity Costs and Working Capital

You will also need to balance the opportunity cost of spending the money on the business premises when compared to other income-generating expenditures. Strategically structuring your financing can free up working capital for your business, where your loan payments are less than your rental expenses. However, you’ll need to carefully consider how your cash flow will be impacted by the purchase, purchasing and outfitting costs, and disruption caused by the move.

It can be beneficial to discuss the timing of your purchase with your accountant to determine whether these considerations outweigh the benefits of purchasing a commercial property. Your accountant will also be in the best position to discuss current tax considerations for your purchase and advise whether now is the best time.

Structuring the Purchase

The legal entity you select to own the commercial property for your business may also factor into your decision making. Commonly, business owners choose self-managed super funds (SMSF), the company itself, or a discretionary trust to purchase the commercial property.

There is a range of individual factors that weigh on the decision here, such as whether your SMSF investment strategy allows for the purpose of a commercial property. Working with an accountant is the simplest way to determine the optimal corporate structure for your purchase.

Tax Considerations When Buying a Commercial Property

When buying a commercial property, you will (generally) be required to pay the GST component upfront. You can then claim the GST on your next business activity statement. It is important to seek advice from an accountant regarding the GST since it can impact the amount to be paid at settlement and the stamp duty payable.

There are also occasionally stamp duty reductions and other tax incentives offered to businesses by the Australian Government. At the time of writing this article, a stamp duty reduction of up to 50% is available for certain commercial property purchases.

Consult Sharp Accounting for Help Determining When To Buy Your Business Premises

Sharp Accounting will work with you to determine whether now is the optimal time for your business to buy a commercial property and, if so, how to best structure that purchase.

Your first consultation with our team is free and there’s no obligation to continue with us after this initial consult. This means you can reach out risk-free for assistance.