SMSF Myths Busted: Is a Self-Managed Super Fund Right for You?

Self-Managed Super Funds (SMSFs) often make headlines for the wrong reasons. If you’ve been wondering whether an SMSF is worth considering, or you already have one but want to make it work harder for you, let’s cut through the noise.

At Sharp Accounting, we work with business owners and individuals who want to take more control over their financial future. While SMSFs aren’t for everyone, they offer flexibility and long-term advantages when used the right way.

Here are the facts, so you can make an informed decision about whether an SMSF is right for you.

Why Set Up an SMSF?

An SMSF allows you to:

- Make your own decisions about how and where your super is invested

- Invest in assets not usually available through standard retail super funds, such as direct property, including business premises

It puts the investment strategy in your hands, rather than relying on a third-party manager.

Is It Expensive to Set Up?

Not at all. Setting up an SMSF involves a one-off fee to prepare your Trust Deed and company trustee structure. At Sharp Accounting, we offer a complete establishment package for $2,300 + GST, which includes:

- All required legal documentation

- ASIC company setup

- Registration with the ATO

To put it in perspective, if you have $200,000 in super, that’s just 1.15% of your balance to take control of your retirement savings. Obviously, with a much larger balance, the % becomes a lot less than this.

What About Ongoing Costs?

Ongoing SMSF administration costs are straightforward:

- From $2,000 + GST per annum for ongoing admin, tax returns, compliance, and financial statements

- From $500 + GST annually for your independent audit

This level of transparency and fixed pricing makes budgeting easy and can be more cost-effective over time compared to retail funds with percentage-based fees.

Do You Need $200,000 to Start?

Despite what you might hear in the media, you don’t need $200,000 to make an SMSF worthwhile. In fact, many of our clients start with $100,000 or less.

Why? Because an SMSF can be used as a family wealth creation tool, it offers insurance options, estate planning flexibility, and the ability to invest in assets such as property (including through borrowing arrangements).

For example, $100,000 in super could be used to purchase a $400,000 property using SMSF lending. That’s $400,000 of capital growing, instead of just $100,000.

What Can You Invest In?

SMSFs can invest in a wide range of assets, including:

- Shares

- Cash and term deposits

- Residential and commercial property

There are specific rules around what you can and can’t do, so it’s essential to get the right advice before jumping in.

SMSF vs Standard Super: What’s the Difference?

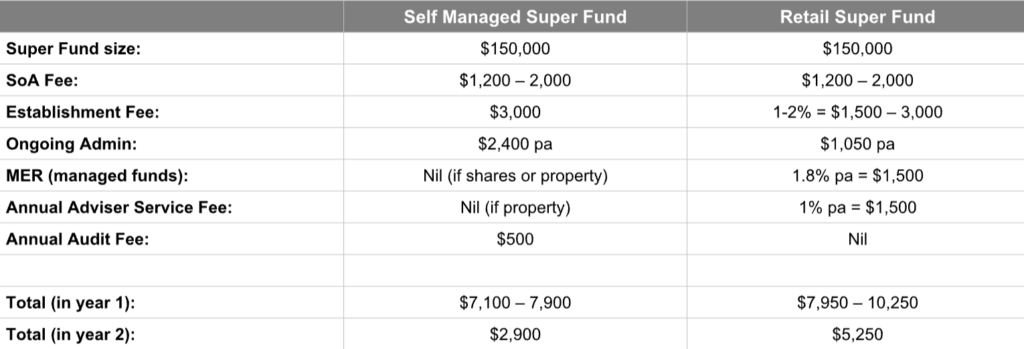

Here’s a side-by-side comparison of an SMSF and a typical retail super fund (such as CBA, BT, or funds offered through most banks or advisers):

Note: Setup and first-year costs are often similar. Over time, SMSFs can become more cost-effective, especially as your balance grows and you avoid percentage-based fees.

Do You Want to Learn More?

We offer a complimentary 30-minute consultation to guide you through your options and help you determine if an SMSF is the right fit for your goals. We’ll show you a personalised SMSF Comparison Report so that you can make a confident and informed choice. Get in touch.

This is the first in a SMSF series of articles, where we’ll dive deeper into the ins and outs of SMSFs, including borrowing arrangements, compliance tips, and investment strategies. Keep an eye out over the coming weeks.