Commercial Stamp Duty Concessions Continuing into 2022

There is good news for buyers looking at commercial properties in regional Victoria. The existing commercial stamp duty concessions on the purchase of commercial properties have not been walked back for 2022. This spells the continuation of savings of 50% on commercial property purchases for interested investors and business owners looking to buy a business premises.

Stamp Duty Exemption For Qualifying Commercial Properties

Regional properties used for commercial, industrial, or extractive use, or properties converted to one of these uses, are eligible for the exemptions.

Some examples of properties that fall under the umbrella of commercial, industrial, or extractive use include:

- Retail and office spaces.

- Restaurants.

- Medical centres.

- Factories.

- Warehouses.

- Storage facilities.

- Processing plants.

- Mines, quarries, wells, and dredging operations.

Qualifying for the Commercial Stamp Duty Concessions

The following requirements must also be met to qualify for the current stamp duty exemption:

The commercial property must be located in regional Victoria.

The commercial stamp duty concessions only apply to properties purchased in regional Victoria (outside of Melbourne). The definition of Regional Victoria includes properties that fall under the purview of the following councils:

- Alpine Shire Council

- Ararat Rural City Council

- Ballarat City Council

- Bass Coast Shire Council

- Baw Baw Shire Council

- Benalla Rural City Council

- Buloke Shire Council

- Campaspe Shire Council

- Central Goldfields Shire Council

- Colac Otway Shire Council

- Corangamite Shire Council

- East Gippsland Shire Council

- Gannawarra Shire Council

- Glenelg Shire Council

- Golden Plains Shire Council

- Greater Bendigo City Council

- Greater Geelong City Council

- Greater Shepparton City Council

- Hepburn Shire Council

- Hindmarsh Shire Council

- Horsham Rural City Council

- Indigo Shire Council

- Latrobe City Council

- Loddon Shire Council

- Macedon Ranges Shire Council

- Mansfield Shire Council

- Mildura Rural City Council

- Mitchell Shire Council

- Moira Shire Council

- Moorabool Shire Council

- Mount Alexander Shire Council

- Moyne Shire Council

- Murrindindi Shire Council

- Northern Grampians Shire Council

- Pyrenees Shire Council

- Borough of Queenscliffe

- South Gippsland Shire Council

- Southern Grampians Shire Council

- Strathbogie Shire Council

- Surf Coast Shire Council

- Swan Hill Rural City Council

- Towong Shire Council

- Wangaratta Rural City Council

- Warrnambool City Council

- Wellington Shire Council

- West Wimmera Shire Council

- Wodonga City Council

- Yarriambiack Shire Council.

The property must be used for a qualifying purpose.

The land must be used for a qualifying commercial, industrial, or extractive purpose for a continuous period of at least 12 months following the settlement of the purchase. However, it is not necessary for the purchaser to use the land for the 12 months. Any party can use the land to meet the qualifying use requirement.

The land must start being used for a qualifying purpose within 2 years.

The purchaser must ensure that the 12 months of continuous qualifying use starts within two years from the time the purchaser gains possession of the land.

For purchasers who have bought a property that is currently being used for a qualifying purpose, this requirement can be easily met if the current use is extended for 12 months. For instance, if you purchase a retail shop and ensure the store stays open for another year, you have met the requirement.

However, for purchasers who intend to build on vacant land, or convert a property to one that meets qualifying use requirements, it is important that you plan to start your qualifying operations within 2 years of possession.

Calculating Your Potential Stamp Duty Savings

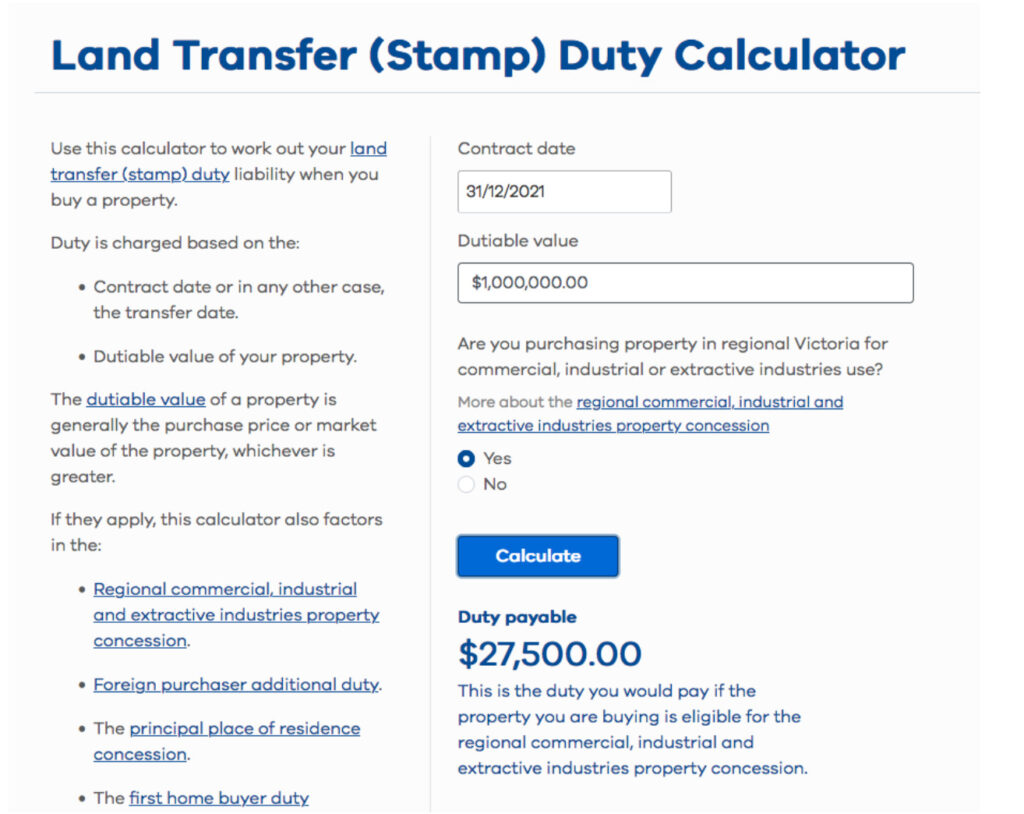

This calculator can be used to calculate your likely stamp duty on the purchase of a commercial, industrial, or extractive property.

Here’s an example of how it works:

You entered a contract of sale on 31 December 2021 for a commercial property in regional Victoria. The purchase price is $1,000,000.

Under the current stamp duty concessions, the stamp duty payable on the property is calculated as being $27,500. In prior years (before 2019), the stamp duty payable could have been as high as $55,000.

Similarly, a qualifying commercial property valued at $500,000 would attract potential savings of around $12,535 (50% of the stamp duty amount).

The Timing of Your Purchase May Impact the Commercial Stamp Duty Concessions Available

Contracts of sale entered into from 1 July 2019 onwards are eligible for stamp duty concessions on the purchase. However, the amount of the concession does vary depending on timing.

- For contracts of sale entered into from 1 January 2021, duty payable is reduced by 50%.

- Where the contract of sale was entered into on or after 27 January 2020 and the property is located in the local government areas of East Gippsland, Mansfield, Wellington, Wangaratta, Towong and Alpine duty payable is reduced by 50%.

- If the contract of sale was entered into from 1 July 2020 to 31 December 2020, duty payable is reduced by 20%.

- For contracts of sale entered into from 1 July 2019 to 30 June 2020, duty payable is reduced by 10%.

At this point, the timing is only likely to impact the stamp duty payable if you purchased a property in 2020 and have been converting it or building a property to meet the qualifying use requirements over the past 2 years.

An interesting final note is that the purchase price of the commercial property is not relevant to the amount of the concession.

For more information about the current commercial stamp duty concessions or to discuss the purchase of a commercial property, reach out.