2022/23 Federal Budget – Highlights

After the budget earlier this week, below we share some highlights:

Personal income tax changes

- Increase to low and middle income tax offset (‘LMITO’)

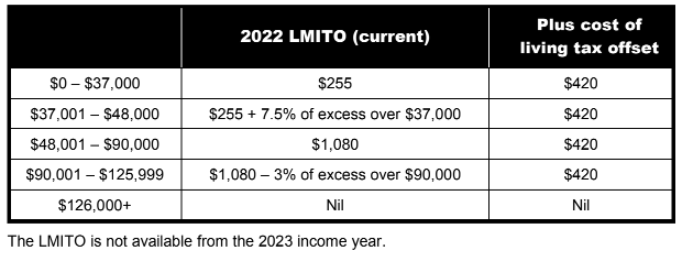

The Government has announced a once-off $420 ‘cost of living tax offset’ for the 2022 income year, which will be provided in the form of an increase to the existing LMITO. This will increase the maximum LMITO benefit to $1,500 for individuals and $3,000 for couples, and will be paid from 1 July 2022 when Australians submit their tax returns for the 2022 income year.

Other than those who do not require the full offset to reduce their tax liability to zero, all LMITO recipients will benefit from the full $420 increase. All other features of the LMITO remain unchanged.

To the extent an individual is entitled to an amount of LMITO for the 2022 income year under the current law, their entitlement is proposed to be increased by $420, as follows:

2. Changes affecting business taxpayers

- Skills and training boost

The Government will introduce a skills and training boost to support small and medium-sized businesses to train and upskill their employees. The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (i.e., Budget night) until 30 June 2024.

Small and medium-sized businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees. The external training courses will need to be provided to employees in Australia or online and delivered by entities registered in Australia.

Some exclusions will apply, such as for in-house or on-the-job training and expenditure on external training courses for persons other than employees.

For eligible expenditure incurred by 30 June 2022, the boost will be claimed in tax returns for the following income year. For eligible expenditure incurred between 1 July 2022 and 30 June 2024, the boost will be claimed in the income year in which the expenditure is incurred.

- Technology investment boost

The Government will introduce a technology investment boost to support digital adoption by small and medium-sized businesses. The boost will apply to eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (i.e., Budget night) until 30 June 2023.

Small and medium-sized businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20% of expenditure incurred on business expenses and depreciating assets that support their digital adoption (such as portable payment devices, cyber security systems or subscriptions to cloud-based services).

An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible for the boost. This equates to a maximum additional deduction of $20,000 per eligible year.

For eligible expenditure incurred by 30 June 2022, the boost will be claimed in tax returns for the following income year. For eligible expenditure incurred between 1 July 2022 and 30 June 2023, the boost will be claimed in the income year in which the expenditure is incurred.

Other budget announcements

- Extending the reduction in minimum drawdowns

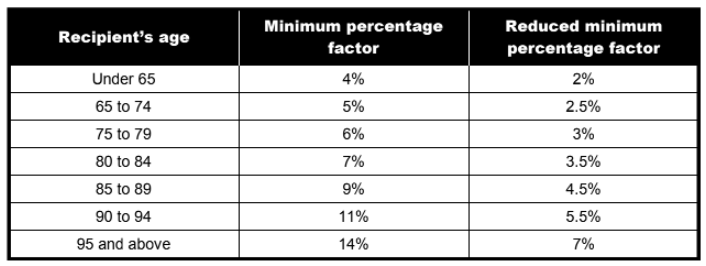

The Government will extend the 50% reduction of superannuation minimum drawdown requirements for account-based pensions (‘ABPs’) and similar products for a further year to 30 June 2023 (i.e., for the 2023 income year).

Based on this change, the (effective) reduced minimum percentage factors for ABPs (including TRISs), which are used to calculate the minimum annual pension amount under Schedule 7 to the SIS Regulations, are set out in the following table for the 2023 income year.

Note that, for ABPs and TRISs that commence or cease part-way through the 2023 income year, a pro-rated minimum pension payment applies (unless the pension commenced on or after 1 June 2023, in which case, no minimum pension payment is required).

- Temporary reduction in fuel excise

The Government will help reduce the burden of higher fuel prices by halving the excise and excise equivalent customs duty rate that applies to petrol and diesel, and all other fuel and petroleum based products except aviation fuels, for six months. This measure will commence from 12.01am on 30 March 2022 and will remain in place for six months.

If you would like to discuss any points above or other elements relating to the 2022-2023 Federal Budget not mentioned, please feel free to contact us.

Content shared from The National Tax and Accountants’ Association Ltd. (NTAA) Federal Budget Summary.