- 5 Reasons Why you should be patient when Investing in PropertySince being back from Christmas Break (which seems like an eternity ago now), I have been asked several times by clients and friends about buying an investment property and whether now is the “right time” to buy. I cannot remember a time when my response to this question hasn’t been that there is never the…

- VOTED Australia’s Best Accounting Firm for Private ClientsSharp Accounting Ballarat is proud to announce that we are the 2018 Professional Services Awards winner for the ‘Best Accounting Firm for Private Clients’ Australia wide, which is backed by NAB. Judged by clients, these awards showcase the best small to medium firms. Each firm was rated on their Expertise, Reliability, Communication and Understanding of client needs,…

- I am passionate about – giving small business owners back time!The majority of the time, a small business is run by a couple – usually with one out doing the work, and the other helping in the background. This is all well and good while the business is starting up, but when growth occurs, we often see the ‘behind the scenes’ workload getting more and…

- Why should I have insurance?When we do our clients personal tax returns we’ll talk to them about their insurances and whether they’ve got life insurance and income protection insurance, TPD total permanent disability insurance etc.. We don’t sell insurance, we don’t any money out of it. We are just making sure that our clients have got themselves covered. We…

- Best Ballarat Accountants – Financial Planning and Wealth CreationA lot of our clients will come to us with concerns around where they are heading in their life and what their retirement might be looking like. So although we don’t necessarily do a lot of financial planning ourselves, we do a lot of wealth creation advice for clients. We have a Ballarat financial planner…

- What will June 30 look like for your business?Tax Planning is an opportunity to analyse the current financial year, project potential tax liabilities and discuss strategies moving forward. Further to this, Tax Planning is an opportunity to have a conversation about your goals and aspirations as both a business owner and personally. With your goals and aspirations in mind, tailored advice can be provided,…

- Find Your Lost Superannuation in 3 StepsDid you know that around $18 billion dollars is sitting in 6.3 million lost super accounts? If you’re one of the many Aussies with one or more lost accounts then you better act quickly. “The federal government has changed the super rules, which means that your ‘lost’ super account could be transferred to the ATO…

- 2018-19 Budget UpdateIf you’re interested in finding out what key changes are most likely to impact you, keep reading. Last week Scott Morrison presented the Turnbull Government’s 3rd budget. This budget is best described as ‘incremental’ and has a large focus on integrity measures and cuts to the individual tax paid by most Australians. Personal Income tax Business…

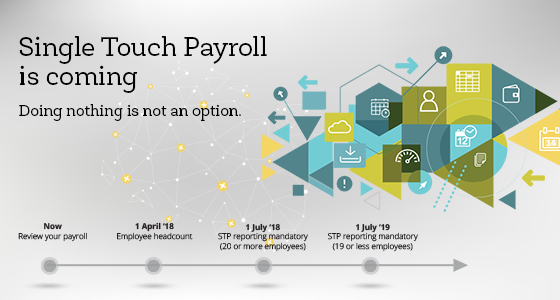

- Single Touch PayrollHi I’m Glenn from Sharp Accounting and today we’ve got a really great question that we’re going to address: I’ve heard there are going to be changes around how wages and superannuation are going to be reported and paid – what does this mean? From the 1st of July 2018, large employers are going to…

- Does property always increase in value?Hi, I’m Glenn Sharp from Sharp Accounting and welcome to our ‘Ask Sharpy’ videos. Does property always go up in value? The common misconception is that property only ever increases in value. It doesn’t always go up in value. All we’ve got to do is go back to the GFC period to see the most…

- Lets look at why you got into business and why it isn’t workingHi, I’m Glenn Sharp from Sharp Accounting and we’re back with ‘Ask Sharpy’. My business isn’t working for me, what should I do? The first thing that we would normally delve into with clients in this situation is to bring you back to the main reasons why you got into business. Most people when they…

- How can I have a successful business?Hi, I’m Glenn Sharp from Sharp Accounting and welcome to our weekly ‘Ask Sharpy’ video. Why should I seek advice? When you’re in business, I use an analogy, similar to a football team. In a football team, the players don’t just run around and look after themselves, you’ve got a coaching team. Over the top…

If you fail to plan, you plan to fail