The first cause of poor cashflow – your cash lockup

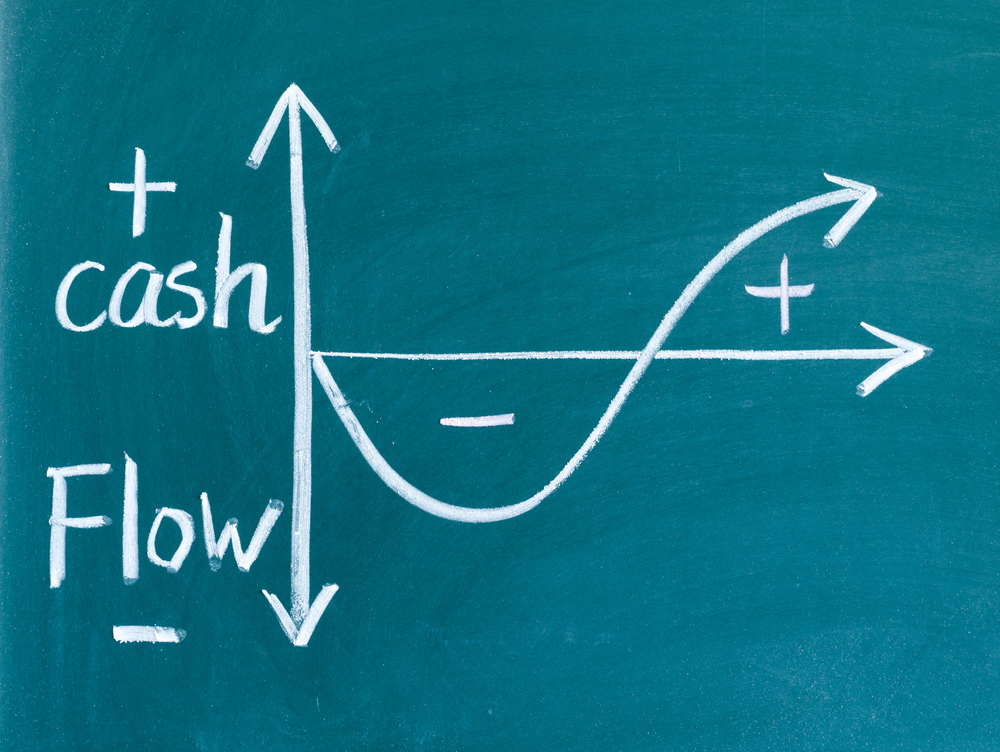

When it comes to business, profit and cash flow are not one and the same. While profit reflects the revenue generated from your work or sales, cashflow is the actual money flowing in and out of your bank account. One of the primary culprits of poor cashflow is what we call “cash lockup.”

Cash lockup occurs when money owed to you is tied up in either work in progress or outstanding invoices awaiting payment. To address this issue effectively, it’s essential to optimise two critical processes within your business: billing and collections.

Optimising Billing Processes

The timing of your invoicing plays a significant role in how quickly you receive payments. Consider invoicing customers promptly upon completion of the work or delivery of goods. If your services span over weeks or months, explore the option of progress billing to generate regular cash inflows.

Enhancing Collections Strategies

Getting paid promptly requires clear communication and streamlined processes. Ensure that customers agree to transparent Terms of Trade before initiating any business transactions. Set clear expectations regarding payment due dates – shortening payment terms can expedite cash inflow significantly.

Make it as easy as possible for customers to settle their accounts. Include links for online payments on your invoices and statements, or provide clear instructions for bank transfers. Offer various payment methods such as direct debit, credit card, and debtor finance, catering to diverse customer preferences. Consider incentivising prompt payments with small discounts to encourage faster settlements.

By implementing these process improvements, you can effectively reduce cash lockup and improve your overall cashflow. Remember, these are just a few strategies among many that can help optimise your financial operations. Reach out to us for a Cashflow and Profit Improvement Meeting, where we can explore tailored solutions to enhance your bottom line – because when it comes to your business, tangible results speak louder than words.

On Wednesday 20 March from 8-9am, Sharp Accounting will be running our Cashflow Freedom Seminar. This will be held at our offices here in Ballarat. Click here to find out more and register at no cost.