Author: Ewen Fletcher

- Business Process Improvement: Ramp Up Accuracy & Efficiency, Through Better ProcessesOver time, even the best business processes become inefficient and outdated. Inflexible legacy systems hamper the introduction of technological innovations. In addition, shifts in consumer preferences, changes in market forces, new regulatory policies, and long-established processes affect efficiency, competitiveness, and even your bottom line. Business Process Improvement is the antidote to this. What is Business…

- Spring 2024 Self Storage Update: Trends and Tips for Business GrowthEwen shares the latest insights on the self storage industry for spring 2024. Discover key trends, including increasing demand and rising rental rates, and get expert tips on reviewing pricing strategies, maximising occupancy, and managing key business costs.. Learn how expanding your facility could help offset rising expenses and boost profitability. The specialist team at…

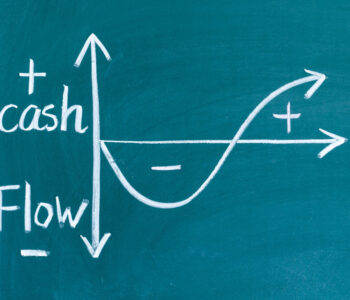

- The Value of Cashflow Forecasting for Your BusinessIn our recent articles, we’ve discussed essential financial reports, such as income statements, balance sheets, and cashflow statements, which provide a snapshot of your business’s financial health at a given point in time. While these reports are crucial for understanding past performance, cashflow forecasting takes it a step further by offering a forward-looking view, helping…

- Why Financial Literacy is Key to Business SuccessUnderstanding your financial reports is crucial to improving your business performance. In this video, Ewen outlines four key reports—profit and loss, balance sheet, accounts receivable, and accounts payable—and explains how monitoring them can enhance cash flow, build stronger supplier relationships, and inform better decision-making. If you’d like a financial review of your business, reach out…

- Sharpen Your Numbers – FAQ: There is not a lot of money in bank, what am I doing wrong in my business?If you’re seeing a low bank balance, it might not be about what you’re doing wrong but where your money is tied up. In this video, Ewen shares tips on assessing your sales, accounts receivable, stock levels, and accounts payable. Discover how these factors impact your cash flow and what you can do to improve…

- Seven Keys to Running a Successful Self Storage Business in 2024In Ewen’s latest self storage industry video, discover the essential strategies for running a successful self storage business in 2024. Learn about: Customer Service: How to exceed expectations and encourage referrals.Gathering Feedback: The importance of reviews and testimonials.Site Selection: Choosing the right location based on demographics.Expense Control: Identifying and managing essential vs. non-essential costs.Site Security:…

- Six Powerful Reasons to Monitor Your Financial ReportsRegularly reviewing your financial reports is crucial for any business owner aiming for growth and success. If you’re not doing this—whether due to a busy schedule or because the reports seem confusing—it’s time to start. Here are six compelling reasons you should monitor your financials reports regularly. Which Financial Reports Should You Review? Before diving…

- Conducting Feasibility Studies for Self Storage: Key Insights on Supply and DemandIn his latest self storage industry video, Ewen dives into the crucial aspects of feasibility studies, focusing on supply and demand. Evaluating the competition is essential if you’ve found a promising site with the right land price and rental rates. Learn how to analyse both established and new competitors, assess their occupancy rates, and understand…

- Navigating the Self Storage Industry: Current Trends, Opportunities, and Evolving DemandEwen highlights current trends and opportunities in this latest self storage industry update. While demand for new developments has slowed and existing storage needs have decreased, several factors drive ongoing demand. These include the increased need for storage due to moves or downsizing, the rise of remote work leading to home office renovations, ongoing home…

- Overcoming Five Common Business Challenges: Strategies for SuccessStarting and growing a small business can be incredibly rewarding but challenging. Preparing for common challenges and knowing how to tackle them can make your journey smoother and more successful. Five Proactive Ways to Overcome Common Business Challenges Every small business faces unique obstacles, but certain challenges are universally common. Here’s how to address five…

- Key Ways to Access Business FundingStarting a new business or expanding an existing one often requires substantial funding. Securing the right finance at each stage of your business journey is crucial for success. But where can you find the necessary funds? Five Ways to Access the Right Funding Here are five key funding options to consider: 1: Bank Loans and…

- Beware of Fake Invoice Scams Targeting BusinessesIn this short video, Ewen shares how many business owners receive fraudulent emails with invoices from familiar suppliers they don’t actually use. These scams often come from well-known names like Australia Post or utility companies, but they include red flags such as overdue invoices, urgent payment demands, and threats of legal action. If you receive…