The Benefits of Better Cash Flow Management

Understanding cash flow management can help you overcome growing pains, reduce the stress of running a business, and deploy cash resources in a way that’s efficient and strategic. But for many businesses, cash flow management isn’t seen as a high priority. In this post, we’ll outline the purpose and benefits of better cash flow and show how it can help your business thrive.

What is Cash Flow Management?

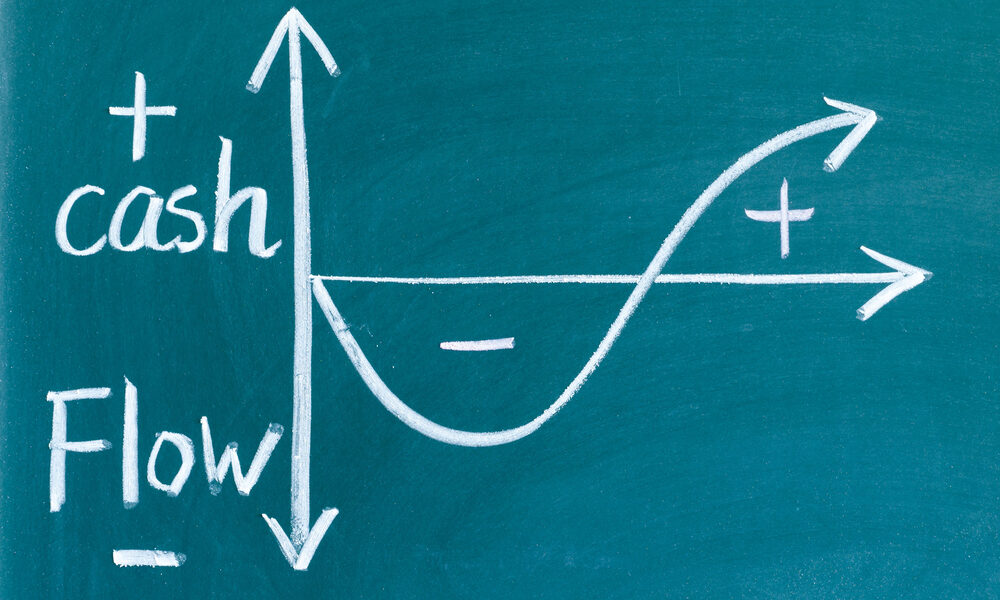

Being profitable and having good cash flow are two different things. Your company might be earning a good amount of money from selling your products or services. However, the money flowing into your business only becomes profit if you don’t need to spend it on your expenses. This means that if you don’t manage your cash flow well, your profits will be eaten into by inefficient expenses and overheads.

Cash flow management is the process of looking at your company’s cash flows and working out how you can increase the amount of incoming cash and/or reduce inefficiencies in your outgoing expenses. While this can help your business to become more profitable, it may also free up financial resources for you to expand your offering or make new hires.

The Purpose of Cash Flow Planning

Every company needs a cash flow plan so you know how much money you are making, what you are spending the money on, and where the gaps are. This will help you make better decisions about expenditure, and it will allow you to budget for future expenses.

Good cash flow planning and management also help you to:

- Make payroll on time and without stress.

- Meet the demand for your products.

- Avoid overspending or inefficient spending.

- Achieve strategic growth targets.

- Reduce the stress of running and managing a business.

- Run a more predictable business.

Cash flow management is also essential for any business implementing cash flow targets. Setting cash flow targets considers where your company is now and how you can stimulate your cash flow to grow. Again, this involves increasing the amount of money flowing into your business. This won’t necessarily result in improved profits unless your outgoing cash flows are carefully managed, too.

First Steps to Manage Your Company’s Cash Flow

We routinely see clients that have issues with cash flow and cash flow planning. For many of these clients, their issues stem from the way their banking has been set up. Common issues include not maintaining enough working capital, or poor loan structuring. It’s important that you work with your accountant to overcome these potential banking setup issues as the first step towards better cash flow management.

Read our tips for improving your business cash flow.

Cash Flow Management with Sharp Accounting

At Sharp Accounting, we work with our clients to develop strong cash flow strategies. Our accountants would be glad to work with you to develop actionable plans to increase your incoming cash flows or ensure your outgoing cash flows are as efficient as possible.

Book your free consultation now: