What is a Director Identification Number (director ID) and do I need one?

You may have heard about the new rules which require directors of Australian companies to obtain a Director Identification Number (director ID). The new requirement to obtain a director ID also applies to individuals who have an SMSF or a trust with a corporate trustee, which is why I wanted to bring this new requirement to your attention. All directors of a company or corporate trustee will need to apply for their own director ID by the prescribed deadline.

We have provided some important information about Director Identification Numbers, including how to apply for one and by when.

An application for a director ID must be made individually and only by those who are applying for the director ID. As you are required to prove your identity as part of the process, our firm, or any other third party, is not able to apply for a director ID on your behalf, but we can help to guide you through the process.

What is a Director Identification Number (director ID)?

A director ID is a unique identifier that directors need to apply for, like a tax file number. If you are a director of multiple companies, you are only required to have one director ID that will be used across all companies. You will keep your director ID forever even if you change companies, resign altogether from your director role(s), change your name, or move overseas.

Why do I need a Director Identification Number?

As part of the Government’s Digital Business Plan, it is rolling out a Modernising Business Registers program which includes the introduction of director IDs. The main purpose is to prevent the use of false or fraudulent director identities as well as to improve the efficiency of the system by making it easier to meet registration obligations and trace director activity and relationships. By improving the integrity and security of business data it is expected to reduce the risk of unlawful activity.

How do I apply for a Director Identification Number?

Step 1: Set up myGovID – If you do not already have a myGovID you will need to set this up before you can apply for your director ID online. You can find information on how to setup your myGovID by downloading the app at: www.mygovid.gov.au/set-up

Note, myGovID is different to your myGov account. Your myGov account allows you to link to and access online services provided by the ATO, Centrelink, Medicare and more, while myGovID is an app that enables you to prove who you are and to log in to a range of government online services, including myGov.

myGovID is an app, downloaded onto your smart device. You will need to have some key documents available to complete the ID checks: Driving Licence, Passport, Medicare Card.

Step 2: Gather your documents – You will need to gather some information that the ATO already knows about you to verify your identity. You will need your tax file number, your residential address held by the ATO, and information from two of the following documents:

- Bank account details

- ATO notice of assessment

- Super account details

- Dividend statement

- Centrelink payment summary

- PAYG payment summary

Most of this information can be downloaded from your myGov account so it may be worthwhile linking to this service ahead of applying for your director ID. Most of this information is also available via our ATO access.

Step 3: Complete your application – Once you have a myGovID and information to verify your identity, you are ready to apply for your director ID. You can click on the following link to start the application process. The application process is quick and should take you less than 5 minutes.

https://abrs.gov.au/persons/ui/secure/start/applyForDirectorID?action=applyfordirectorid

Further information about the application process, and step-by-step instructions, can be found via this link: https://www.abrs.gov.au/director-identification-number/apply-director-identification-number

By when do I need to have a Director Identification Number?

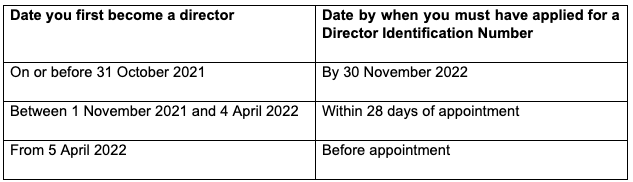

The director ID deadline depends on when you were first appointed as a director of any Australian company. This may or may not be when your SMSF corporate trustee company was established. Please contact our office if you are unsure which deadline applies to you.

How can we help?

We are here to help if you have any questions.

If you would like Sharp Accounting to take care of this process for you, there will be a charge of $450 + GST per director ID. Contact us for details.